What is a Base and Quote Currency in Forex?

Trading forex involves buying one currency and selling another simultaneously. Through careful analysis, traders predict the potential direction of currency prices and attempt to capture gains based on price fluctuations. There is no centralised exchange for forex trading. Rather, it takes place electronically or online, between networks of global computers. The market is open 24 hours a day, 5 days a week.

MetaTrader 5 are the world’s most popular forex trading platforms offering 70+ currency pairs along with a wide range of metals, commodities, and indices from global exchanges.

You can also access the world’s biggest exchanges such as ASX, NASDAQ and NYSE. Enjoy Direct Market Access (DMA) pricing through our Iress platform and trade thousands of stocks. Choose your favourite products and start trading today.

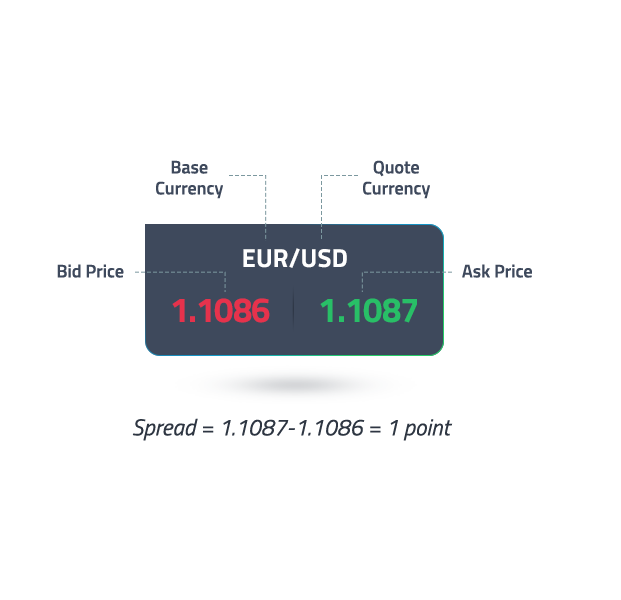

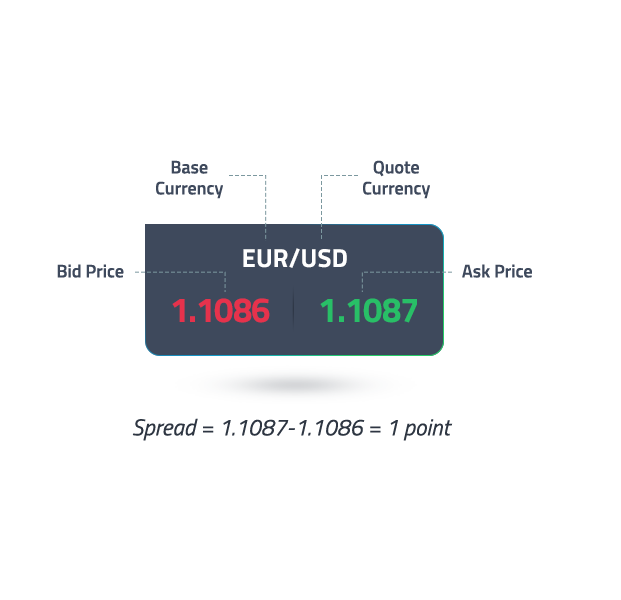

Major currency pairs have the tightest spreads.

EUR/USD: Euro/US Dollar (aka Fiber)

GBP/USD: British Pound/US Dollar (aka Cable)

USD/JPY: US Dollar/Japanese Yen (aka Ninja)

USD/CHF: US Dollar/Swiss Franc (aka Swissy)

CAD/USD: Canadian Dollar/US Dollar (aka Loonie)

AUD/USD: Australian Dollar/US Dollar (aka Aussie)

NZD/USD: New Zealand Dollar/US Dollar (aka Kiwi)

Start Trading NowThen comes a category of minor currency pairs, otherwise known as cross-currency pairs. They are called so because they do not include the US Dollar. So, to convert one into the other, the US Dollar will need to act as a mediating currency.

EUR/GBP: Euro/British Pound (aka Chunnel)

EUR/AUD: Euro/Australian Dollar

CHF/JPY: Swiss Franc/Japanese Yen

GBP/JPY: British Pound/Japanese Yen (aka Gopher)

GBP/CAD: British Pound/Canadian Dollar.

Start Trading NowExotics can include a major currency with an emerging market currency. Trading in exotics is considered risky, since they tend to have low liquidity, wider spreads and political instabilities in these countries can make these currencies volatile.

Some examples are:

EUR/TRY: Euro/Turkish Lira

USD/HKD: US Dollar/Hong Kong Dollar

AUD/MXN: Australian Dollar/Mexican Peso

Start Trading Now